How important are NZ wine exports to China and Asia?

How important are NZ wine exports to China and Asia?

The mainstream NZ media are full of reports of the importance of China and Asia as trading partners to New Zealand. But how important and significant are current NZ wine exports to China and Asia?

Coriolis compiled a report in 2014, which states that: “China is an emerging growth market for wine globally and is now the fourth largest wine consuming country in the world in total (not per capita) volume, nipping at the heels of Germany. China is now New Zealand’s #5 wine export destination and the fastest growing market by value.”

However, not all NZ wineries are targeting China and Asia

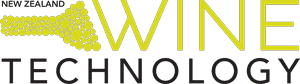

A 2014 study by Deloitte and New Zealand Winegrowers revealed that large wineries (those with annual revenues in excess of NZ$20m) are shipping approximately 3% of their wine to China and Asia by volume.

Rather, it is the smaller wineries that are selling large percentages of their produce to these regions.

Source: ‘Vintage 2014: New Zealand wine industry benchmarking survey’ – a joint publication from Deloitte and New Zealand Winegrowers, December 2014.

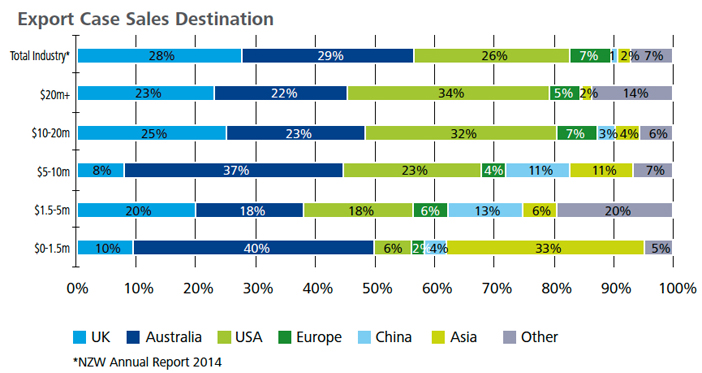

It is also these smaller wineries that are focusing on mid-to-high-end prices per bottle – the larger wineries are producing mostly cheaper and cask wines:

Source: ‘Vintage 2014: New Zealand wine industry benchmarking survey’ – a joint publication from Deloitte and New Zealand Winegrowers, December 2014.

From this we can conclude that wine exports to China are mostly higher-priced wines from smaller wineries.

(See also this article with more NZ wine export information.)

What types of wine are in demand in China and Asia?

The types of wine in demand in China and Asia are a reflection on Asian mega-trends, such as rising incomes, conspicuous consumption, branded luxury and gifting. Consequently, it is the super-premium sector in many industries that are flourishing.

Thus it’s not surprising that the wine market in China and Asia is dominated by France; in particular, premium French wines as well as Champagne.

How does New Zealand fit into the picture?

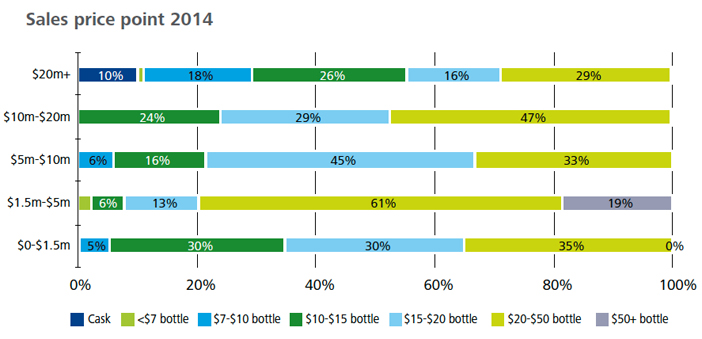

The Coriolis/NZ Government report of July 2014 (‘What does Asia want for dinner? A drink’) is on the right track in describing the NZ wine industry as “still too much of a ‘one-trick-pony’ with an over-reliance on Marlborough Sauvignon Blanc; need to diversify.”

The report states that whilst it is a stretch for New Zealand to develop the capabilities to deliver the wine products wants, it is not impossible, and NZ has some clear capabilities and strengths. After all, New Zealand already demonstrates an ability to demand premium prices for its wines.

So, what are the opportunities for NZ wine exports to China and Asia?

At present, New Zealand only competes seriously in the white wine market; other segments present good opportunities for growth.

Just take a look at what New Zealand exports:

Source: ‘What does Asia want for dinner? A drink’ – a report from Coriolis for the NZ Government’s Food and Beverages Review, July 2014.

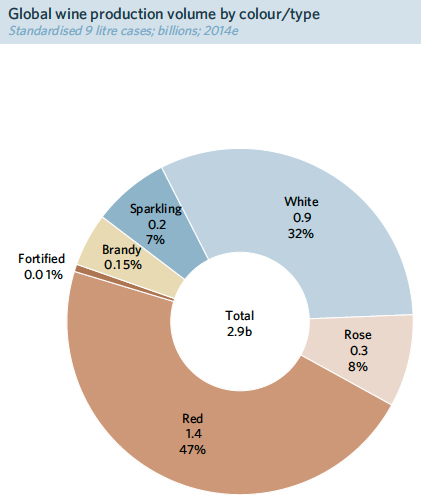

Compare that to what’s being produced globally:

Source: ‘What does Asia want for dinner? A drink’ – a report from Coriolis for the NZ Government’s Food and Beverages Review, July 2014.

These charts show just how over-reliant the NZ wine industry is on Sauvignon Blanc exports – and there are opportunities for developing Sparkling Wines, Rose, Red Wines, and Fortified Wines (bearing in mind climatic and geographic requirements for such varieties).

Indeed, the Coriolis report recommends that: “The New Zealand wine industry needs to diversify away from a single region; French experience suggests that New Zealand should have 5-6 regions of similar size each specialising more clearly.”

Should we learn from France’s experience?

Whilst the French wine industry is undoubtedly different to the NZ wine industry, it is wise to see what can be learnt from their success.

And yes, the French are very successful at exporting into East and South-East Asia: they are beating New Zealand across the 3 most important metrics:

- The French are exporting 39 times more volume of wine (in litres) to East and SE Asia than New Zealand.

- The average price of French wines is 38% higher than NZ wines in E/SE Asia.

- In terms of value, the French are exporting 54 times more in monetary terms to E/SE Asia than New Zealand.

Of course, France is a much bigger country geographically than NZ, and so they can devote more area to growing grapes. (France had a total of 760,805 hectares of vineyards in 2013, compared to 35,733 in New Zealand.)

But they are definitely doing a lot of things right, so the NZ wine industry needs to look at what we can learn and implement here in New Zealand to keep us in the game.

The importance of marketing and branding

Earlier in this article, it was mentioned that key trends in China and Asia include rising incomes, conspicuous consumption, branded luxury and gifting.

In short: premium brands have everything to gain.

And premium brands are created through clever marketing and branding: it’s all about perception and the experience around the brand.

But that’s where a Catch-22 comes into play: currently, it’s the smaller NZ wineries that are doing well in the Chinese and Asian markets. But these small wineries simply don’t have the budgets to spend on the kind of marketing and advertising to create a mega-brand. Nor do they have the volume to support it. They’ll struggle to create a kiwi version of Taittinger or Moet.

You see, these small wineries simply don’t have the economies of scale to operate super-efficiently. Their gross margin is considered to be below sustainable levels, and they might make 3.3% profit… if they’re lucky. So they don’t have the deep pockets to create a Veuve Cliquot.

And the large NZ wineries that would have the budget are focused on lower-cost, mass-produced bottled wine and casks.

So until this situation sees some change, NZ wine exports to China and Asia are likely to continue to be precarious.

Why packaging might be the answer

Whereas marketing and advertising is expensive, all wine needs packaging. Sure, embossed or foil-stamped wine labels are more expensive than run-of-the mill labels, a good graphic designer can make much out of very little.

But wine packaging doesn’t begin and end with labels. Remember, gifting is a key trend in Asia.

Yet giving a bottle of wine by itself isn’t very exciting. No matter now nice the label, it’s still just a bottle of wine.

Rather, putting the wine into a matte-finish, premium carton. Or an embossed wooden box. Or any other kind of premium gift packaging… and voila, there’s an impressive gift. And Asian consumers are willing to pay extra for the wow-factor (also known as fancy packaging). So it’s very likely that a savvy investment in packaging would pay off.

Summary

- Wine exports to China are mostly higher-priced wines from smaller wineries.

- Asian mega-trends, such as rising incomes, conspicuous consumption, branded luxury and gifting, are having an influence on the wine industry.

- NZ wine exports are over-reliant on Marlborough Sauvignon Blanc; it is considered a one-trick pony.

- The French are flouncing NZ wine exports in E/SE Asia in terms of volumes, average prices and value – as well as the variety in their range. The NZ wine industry could observe and learn from what the French are doing, even though our land area and geographical conditions vary.

- There are potential opportunities for NZ wine exporters to create premium brands; the challenge is that the smaller wineries that are currently exporting into China and Asia don’t have the margins to do this, and the large wineries are focusing on the cheaper end of the market (and not exporting much into China and Asia).

- There are also potential opportunities for NZ wine exporters to invest in premium packaging, to tap into the Asian mega-trend of gifting.

Sources:

- ‘Vintage 2014: New Zealand wine industry benchmarking survey’ – a joint publication from Deloitte and New Zealand Winegrowers, December 2014.

- ‘iFAB 2013 Beverages Review’ – a report from Coriolis for the NZ Government’s Food and Beverages Review, January 2014.

- ‘What does Asia want for dinner? A drink’ – a report from Coriolis for the NZ Government’s Food and Beverages Review, July 2014.